NEW FINANCING MODELS

4.8

Financial reporting: basics and standards

Choosing the right reporting standard depends not only on your activities, but also on your constituents. The process of financial accounting is circular. Thus, it is not only about reporting at the end of the year.

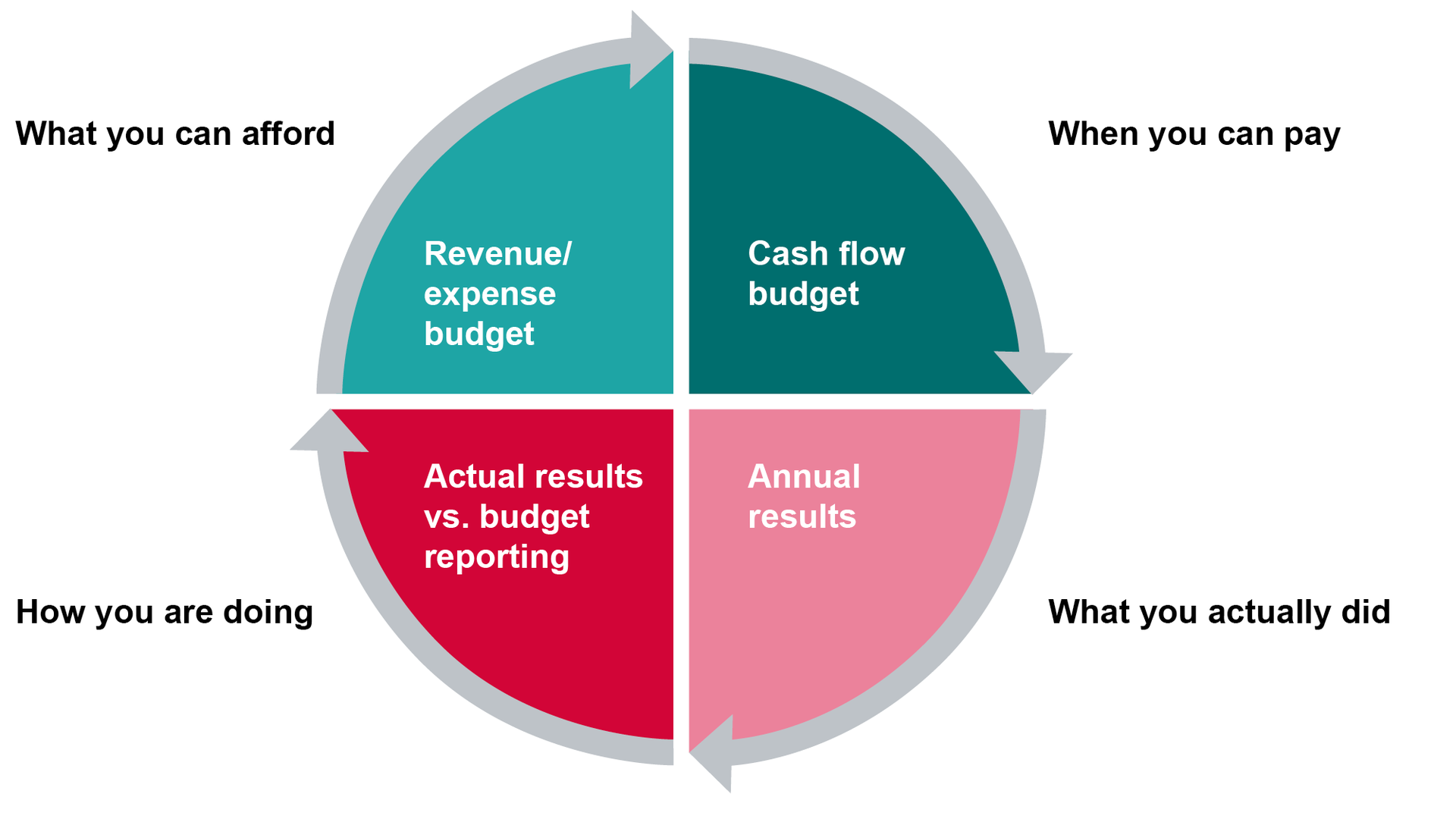

As you can see in the figure below, there are four major phases of financial accounting. We have already looked at budgeting and cash flow management. It is clear that good financial management depends on a solid and regular data management. Thus, numbers are not collected at the end of the year, but continuously. Additionally, you have to control the current state of your financials, depending on the state of your organization. In a startup phase you might check the budget and actual results every week, in a more established organization every month or every quarter year is sufficient.

Financial management process

For the annual reporting, two instruments are of major importance: the balance sheet and the activity statement. The balance sheet gives information about the financial situation of an organization at one specific point in time. The activity statement offers information about the financial development over a specific period of time, usually one year. Today, softwares or online tools assist in preparing the annual report, so we will not go into further detail.

Perceptions of the financial situation can differ strongly. But it is important that outsiders such as lenders, donors, or state institutions get the right image of your organization’s financial situation. In order to provide reliable information, it is necessary to follow a general and accurate way of reporting. A very common international standard is the General Accepted Accounting Principles (GAAP) that comprises a set of rules and conventions on how to provide financial information. Additionally, national law usually sets guidelines for financial accounting.

However, these rules – and GAAP as well – were developed for business companies. Thus, they do not always fit nonprofit expectations. Therefore, some countries have developed accounting standards for nonprofits (ie Switzerland) and there are private self-regulation organizations that expect a certain standard of reporting in order to receive their label (Bies, 2010). On an international level, the International Accounting Standards Board (IASB) publishes the International Financial Reporting Standards (IFRS) that are accepted in more than 120 countries.

References

Bies, A. (2010). Evolution of Nonprofit Self-Regulation in Europe. In Nonprofit & Voluntary Sector Quarterly, 39(6), 1057-1086.

Lizenz

University of Basel