NEW FINANCING MODELS

4.6

Budgeting for good

Budgeting is the process of operationalization of the financial plan. Depending on the size and activities of the organization, budgeting can vary strongly, but it has to be done in any organization.

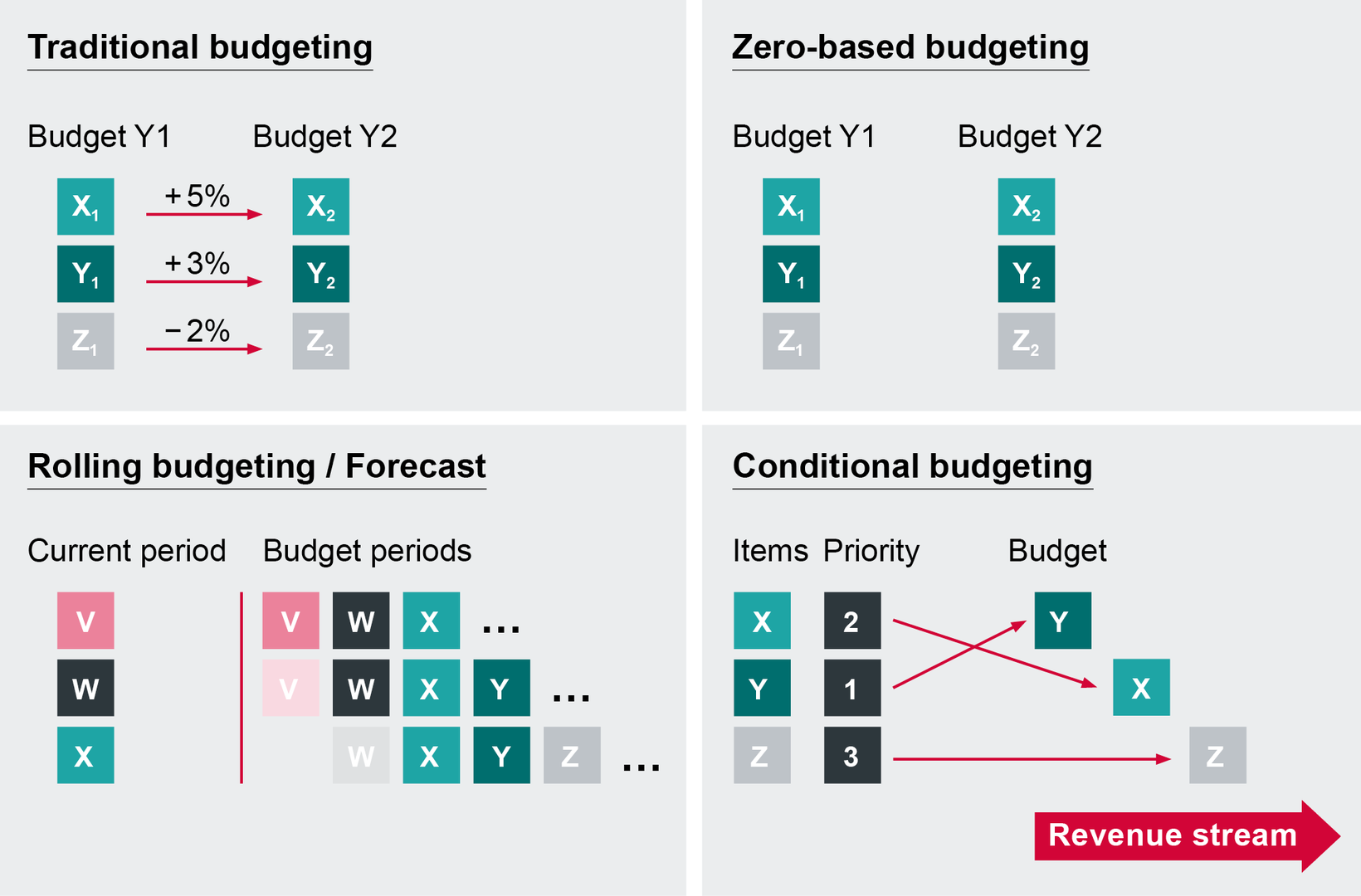

Budgeting entails prognosis on future costs and revenues (Finkler et al., 2017). This can be done in very different ways, as figure 1 shows. In many organizations, the annual budget is based on the results of the previous year. This traditional method is very simple, but it entails the danger of a ‘lock-in’, eg the organization does not develop because it is only repeating the same year. Thus, budgeting should be based on strategic decisions.

If the budgeting process is done without any reference to previous results, we call it zero-based budgeting. Another option is a rolling budget that constantly includes the most recent time periods. This method acknowledges the tendency that operations are often not bound to one budget period anymore, but are flexible, revolving, and intersecting. Finally, conditional budgeting addresses the need to differentiate between more and less important tasks.

Figure 1: Budgeting concepts

Zero-based budgeting

Zero-based budgeting starts with the assumption that no process or expense is constantly necessary. Thus, for every budget period a new decision on every budgetary item is needed. The advantage of zero-based budgeting is that every budgeting process has a strategic and future oriented perspective, as one always asks if an item is still necessary in the next year. However, the effort and time involved in preparing the budget is higher. Additionally, if one does not rely on previous data, it is difficult to set the right figures. Finally, not all activities or tasks in the organization have to be questioned every year. Thus, zero-based budgeting can develop into a routine practice, if it is applied constantly. However, it may help to keep the organization flexible when using it with intervals of several years.

Rolling budget/forecast

A rolling budget is more like a constant forecast of the cash flow of the organization. The budgeting period is always available for a fixed period of time (ie 12 months) by adding a month or a quarter in the future, when one month or quarter has ended. As a result, the budget is not bound to one calendar year but is constantly developing. Especially for organizations with projects of several years, a rolling forecast is closer to reality than a year-to-year perspective.

Conditional budgeting

Finally, conditional budgeting takes into account that not all budgeting items have the same importance. Thus, the aim of the budgeting process is not that a certain amount of money has to be spent, but to define priorities of expenses and the respective levels of income that will allow releasing the funds for resource consumption.

Overall, budgeting is not only a basis for operative action, but it has an important strategic role. Thus, for your social initiative you should select a more strategic approach than just adopting last year’s budget.

For further explanations on the budgeting concepts see Finkler et al. (2017), pp 85-98.

References

Finkler, S.A., Smith, D.L., Calabrese, T.D. and Purtell, R.M. (2017). Financial Management for Public, Health, and Not-for-Profit Organizations, 5th ed. Los Angeles: Sage.

Lizenz

University of Basel

Downloads